The Top Factors Why Homeowners Choose to Secure an Equity Car Loan

For numerous homeowners, picking to protect an equity car loan is a critical monetary choice that can use various benefits. The capability to use the equity constructed in one's home can offer a lifeline throughout times of financial requirement or serve as a tool to attain specific objectives. From combining debt to carrying out major home restorations, the reasons driving individuals to select an equity finance are impactful and varied. Understanding these motivations can shed light on the sensible financial planning that underpins such options.

Debt Debt Consolidation

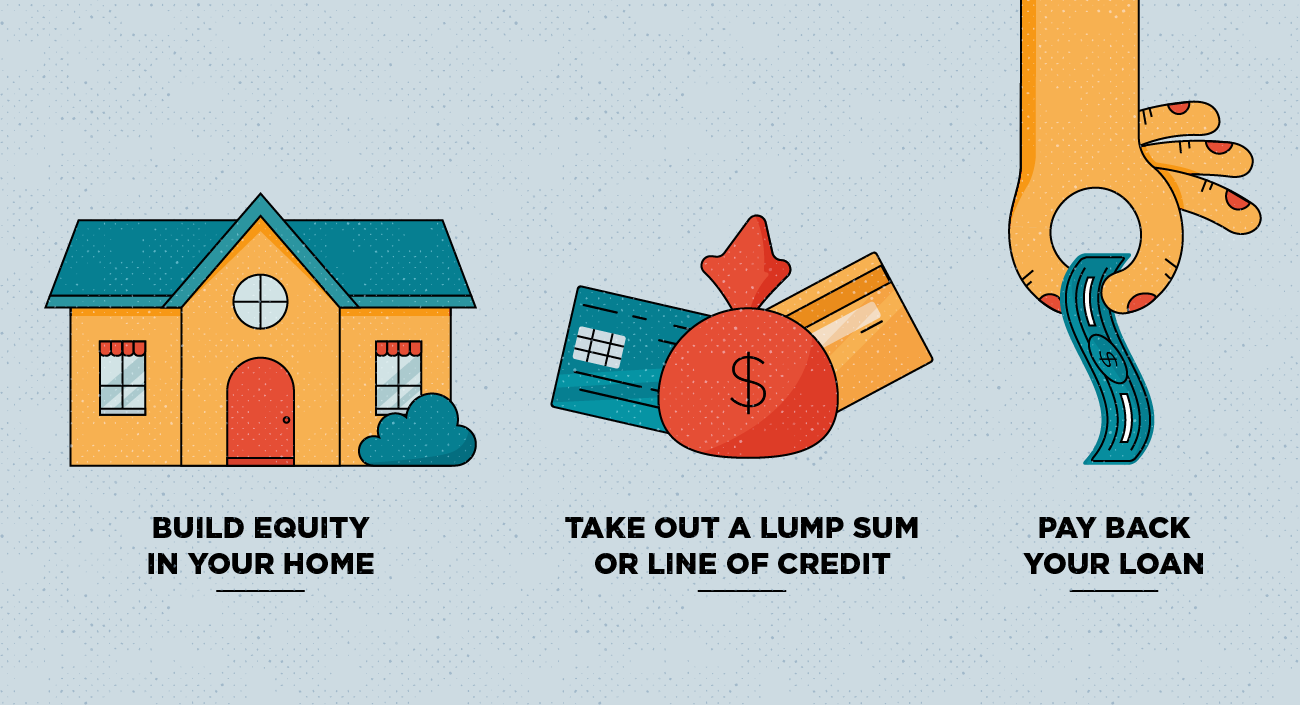

House owners typically choose for securing an equity car loan as a calculated monetary step for financial obligation consolidation. By leveraging the equity in their homes, people can access a swelling amount of cash at a reduced rates of interest contrasted to various other kinds of borrowing. This capital can then be made use of to pay off high-interest debts, such as credit score card balances or personal lendings, enabling home owners to simplify their monetary obligations into a single, a lot more workable month-to-month payment.

Financial debt debt consolidation through an equity loan can provide numerous benefits to house owners. First of all, it simplifies the repayment process by integrating several debts into one, reducing the danger of missed out on settlements and potential charges. Second of all, the lower rates of interest related to equity loans can result in significant cost financial savings over time. Additionally, consolidating financial debt in this manner can enhance a person's credit rating by decreasing their total debt-to-income ratio.

Home Enhancement Projects

Considering the enhanced worth and capability that can be achieved with leveraging equity, numerous individuals choose to designate funds towards various home renovation tasks - Alpine Credits Home Equity Loans. Homeowners typically choose to protect an equity car loan specifically for renovating their homes due to the substantial rois that such projects can bring. Whether it's updating obsolete attributes, increasing space, or enhancing energy effectiveness, home renovations can not only make living rooms more comfy yet additionally boost the total worth of the home

Usual home renovation projects funded with equity loans include kitchen remodels, washroom restorations, cellar completing, and landscaping upgrades. By leveraging equity for home renovation projects, property owners can produce rooms that far better match their needs and preferences while likewise making a sound monetary investment in their building.

Emergency Situation Expenditures

In unpredicted circumstances where immediate financial support is needed, safeguarding an equity car loan can provide property owners with a practical service for covering emergency costs. When unforeseen events such as medical emergencies, urgent home repairs, or sudden job loss arise, having accessibility to funds via an equity financing can offer a safeguard for house owners. Unlike other kinds of borrowing, equity loans typically have reduced passion prices and longer repayment terms, making them an affordable option for resolving immediate monetary needs.

One of the vital benefits of using an equity lending for emergency expenditures is the speed at which funds can be accessed - Alpine Credits. Homeowners can rapidly tap into the equity built up in their residential or commercial property, enabling them to deal with pressing financial issues right away. Additionally, the flexibility of equity loans enables homeowners to obtain just what they need, avoiding the burden of taking on too much financial debt

Education And Learning Financing

Amid the quest of college, protecting an equity loan can act as a calculated funds for house owners. Education and learning funding is a considerable problem for several family members, and leveraging the equity in their homes can offer a means to access needed funds. Equity lendings this post commonly offer lower rates of interest compared to various other forms of financing, making them an eye-catching option for financing education and learning expenses.

By using the equity developed in their homes, homeowners can access substantial quantities of cash to cover tuition fees, books, lodging, and various other related costs. Home Equity Loan. This can be specifically advantageous for parents seeking to sustain their children through college or individuals seeking to advance their very own education and learning. In addition, the interest paid on equity car loans may be tax-deductible, giving potential economic advantages for customers

Inevitably, making use of an equity loan for education financing can aid people purchase their future earning capacity and occupation advancement while efficiently handling their economic obligations.

Financial Investment Opportunities

Conclusion

To conclude, property owners choose to secure an equity loan for various factors such as financial debt combination, home enhancement projects, emergency expenditures, education and learning funding, and investment possibilities. These loans give a method for property owners to access funds for important economic requirements and goals. By leveraging the equity in their homes, homeowners can benefit from lower rates of interest and adaptable repayment terms to achieve their economic purposes.

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Comments on “Home Equity Loan Benefits: Why It's a Smart Financial Relocate”